Introduction

As cryptocurrencies continue their journey from fringe technology to mainstream finance, digital wallets have become an essential tool for anyone participating in the crypto space. Whether you’re holding Bitcoin for the long haul or actively trading altcoins, your digital wallet acts as both vault and gateway—storing your assets and enabling transactions with the wider blockchain ecosystem.

But with a dizzying array of wallet options and features, where do you begin? From hot wallets on your phone to cold storage in hardware form, understanding how digital wallets work—and how they differ—is crucial to protecting your crypto and using it effectively. Let’s break down the essentials and explore what makes a digital wallet tick.

Types of Digital Wallets: Hot vs Cold Wallets

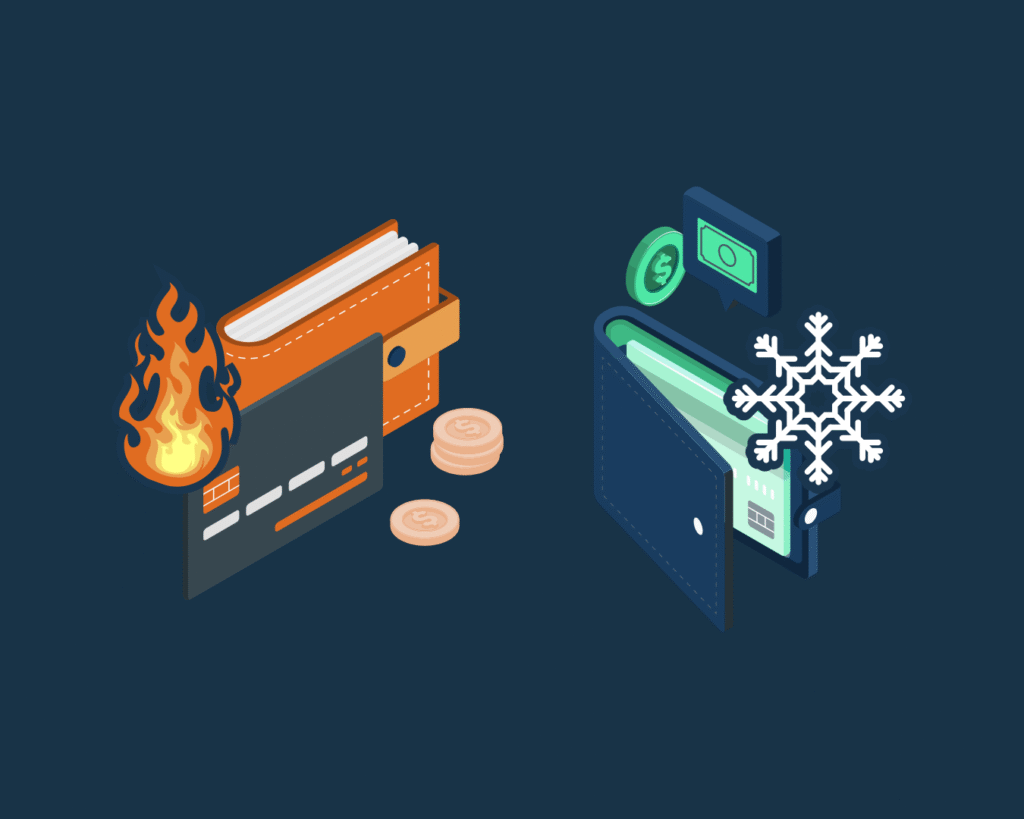

At the highest level, digital wallets fall into two broad categories: hot wallets and cold wallets. The key difference? Internet connectivity.

Hot wallets are connected to the internet. These include mobile apps, desktop software, and web-based wallets. They’re convenient for quick transactions and frequent trading—but more vulnerable to hacks due to constant online exposure.

Cold wallets, on the other hand, are offline storage solutions. These include hardware wallets (like Ledger or Trezor) and even paper wallets, where private keys are written or printed and stored physically. Cold wallets are ideal for long-term storage because they’re much harder to compromise remotely.

So, hot wallets = convenience. Cold wallets = security. Many users opt for both, depending on the purpose—using hot wallets for everyday use and cold wallets for larger, long-term holdings.

Security Measures and Features of Digital Wallets

Security is a top concern for anyone storing digital assets, and wallets today come with a range of protective features. Here’s what you should expect—and demand—from your wallet provider:

- Private Key Control: At the core of any wallet is a private key. This is your proof of ownership over the assets in the wallet. Some wallets (called custodial wallets) store these keys for you; others (non-custodial wallets) give you full control. If you want true ownership, go non-custodial.

- Encryption: Your wallet and keys should be encrypted on your device, making them unreadable without the correct password or passphrase.

- Two-Factor Authentication (2FA): Adds an extra layer of security beyond your password. A must-have for hot wallets.

- Biometric Access: Many mobile wallets offer fingerprint or facial recognition for fast, secure logins.

- Multi-Signature Support: Some wallets allow transactions to require more than one signature. This is useful for shared wallets or business accounts.

- Backup and Recovery Options: Look for wallets that offer a recovery phrase (typically 12 or 24 words). Lose this and you lose access—so it’s critical to store it somewhere safe.

Remember: security is not just about features—it’s also about your habits. Use strong passwords, avoid phishing links, and never share your recovery phrase.

Popular Digital Wallet Options: Pros and Cons

There’s no one-size-fits-all wallet. Here’s a snapshot of some widely used wallets and what they bring to the table:

1. MetaMask (Hot Wallet – Browser/Mobile)

Pros: Easy to use, integrates with DeFi and NFTs, supports multiple blockchains.

Cons: Browser-based means higher risk if compromised. Requires careful use.

2. Ledger Nano X (Cold Wallet – Hardware)

Pros: Extremely secure, supports a wide range of cryptocurrencies.

Cons: Costs money, not ideal for beginners or frequent traders.

3. Trust Wallet (Hot Wallet – Mobile)

Pros: User-friendly, supports many assets, includes staking and dApp support.

Cons: Mobile-only, so still exposed to potential device vulnerabilities.

4. Exodus (Hot Wallet – Desktop/Mobile)

Pros: Beautiful UI, integrated exchange, supports multiple assets.

Cons: Not fully open-source, which some privacy-minded users may dislike.

5. Trezor Model T (Cold Wallet – Hardware)

Pros: Open-source, high-level security, touchscreen interface.

Cons: Like Ledger, costs more and has a learning curve.

How to Choose the Right Digital Wallet for You

Choosing the right wallet comes down to your needs, habits, and risk tolerance. Here are some questions to ask yourself:

- How often do I trade or transact?

If daily, consider a hot wallet with robust security. - How much crypto am I holding?

Larger amounts are better stored in a hardware wallet. - Do I use DeFi platforms or NFTs?

MetaMask or other Web3 wallets are best suited for interacting with decentralized apps. - Am I a beginner or seasoned user?

Simpler interfaces like Trust Wallet or Exodus are great for newcomers. Hardware wallets may require more setup but offer better long-term protection. - Do I want full control over my keys?

Non-custodial wallets are essential if you value decentralization and ownership.

Ultimately, the best wallet is one that balances security and convenience for your specific use case.

Using Your Digital Wallet: Transactions, Conversions, and Tracking

Digital wallets do more than just store your crypto—they’re the control center for how you interact with the blockchain.

- Transactions: You can send and receive crypto using wallet addresses. Always double-check these, as transactions are irreversible.

- Conversions: Some wallets allow in-app conversions between different cryptocurrencies. This makes it easier to swap tokens without using a third-party exchange.

- Gas Fees: Especially on Ethereum, you’ll need to manage gas fees. Many wallets offer options to speed up or economize transactions depending on network congestion.

- Portfolio Tracking: Advanced wallets display your balance, value changes, and transaction history—some even include charts and alerts for better monitoring.

Keep in mind: wallets are not banks. They don’t insure your funds, and mistakes can’t be undone. Education and vigilance go a long way here.

The Future of Digital Wallets in the Crypto Space

As blockchain technology evolves, so too will digital wallets. We’re already seeing smart wallets that integrate AI, multi-chain compatibility, and better UX design.

Some trends to watch:

- Integration with TradFi (Traditional Finance): Wallets may bridge the gap between fiat and crypto, with built-in on-ramps and off-ramps.

- Wallet-as-Identity: Your crypto wallet could become your decentralized login across web3 platforms—replacing usernames and passwords.

- Enhanced Interoperability: Cross-chain compatibility will let users manage assets across multiple blockchains in one place.

- Social Recovery: New models are emerging to recover wallets without relying solely on seed phrases—great news for users prone to losing passwords.

As the crypto space matures, wallets will play an even bigger role—not just as a storage solution, but as your digital passport to decentralized finance.

Conclusion

Digital wallets are your gateway into the world of crypto, and choosing the right one isn’t just a technical decision—it’s a personal one. Whether you value security above all, or you’re looking for seamless integration with DeFi and NFTs, there’s a wallet tailored to your needs.

Understanding the differences between hot and cold wallets, the importance of security features, and how to use your wallet effectively is the first step toward confidently navigating the crypto landscape. Just remember: in crypto, you are your own bank. And with great power comes great responsibility—so choose wisely, stay informed, and keep your keys safe.